Expanding your business internationally? Bahrain offers a strategic location, a pro-business environment, and a streamlined registration process for foreign company registration in Bahrain. Whether you’re looking to establish a branch office, a subsidiary, or a joint venture, this guide provides a comprehensive overview of foreign company registration in Bahrain.

Bahrain is a thriving economic hub offering unmatched opportunities for foreign companies. Its strategic location in the Middle East, business-friendly policies, and access to regional markets make it an ideal destination for international businesses. Foreign companies looking to establish a presence in Bahrain can benefit from streamlined registration processes, robust infrastructure, and government support for investors.

Foreign Company Registration in Bahrain

Why Register a Foreign Company in Bahrain?

- Strategic Location: Bahrain is centrally located, offering easy access to key GCC markets, including Saudi Arabia, the UAE, and Kuwait.

- Tax-Friendly Environment: With no corporate or income taxes for most businesses, Bahrain ensures a cost-effective business environment.

- Strong Financial Sector: Bahrain’s advanced banking system and liberal regulations provide ease of doing business for foreign companies.

- Government Incentives: Foreign investors enjoy 100% ownership in most sectors, free trade agreements, and support programs.

- Skilled Workforce: A multilingual and highly educated workforce is readily available to support your business operations.

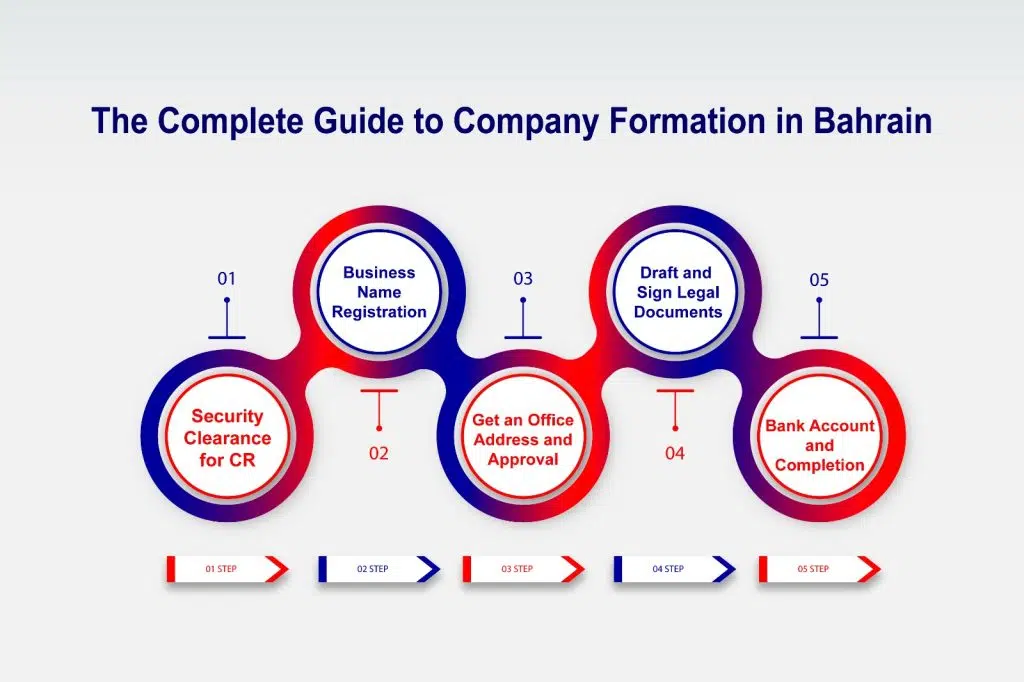

Steps to Register a Foreign Company in Bahrain

- Choose a Legal Entity Type: Decide whether to register as a branch office, representative office, or subsidiary.

- Reserve a Trade Name: Select and register a unique trade name for your company.

- Prepare Documentation: Gather required documents, including a certificate of incorporation, articles of association, and shareholder details.

- Submit Application to MOICT: Apply for a Commercial Registration (CR) through the Ministry of Industry, Commerce & Tourism (MOICT).

- Obtain Licenses: Secure necessary sector-specific approvals and licenses based on your business activities.

- Open a Bank Account: Establish a corporate bank account to manage financial transactions.

- Set Up Office Space: Secure a physical address or virtual office in Bahrain to meet regulatory requirements.

Why Choose Bahrain for Your Business Expansion?

Bahrain is a thriving economic hub in the heart of the Middle East, offering numerous advantages for foreign investors:

- Strategic Location: Positioned in the Gulf, Bahrain provides easy access to the lucrative markets of Saudi Arabia, the UAE, and other GCC countries.

- Pro-Business Environment: The Bahraini government actively encourages foreign investment with initiatives like tax benefits, streamlined regulations, and 100% foreign ownership in many sectors.

- World-Class Infrastructure: Bahrain boasts modern infrastructure, including a well-developed transportation network, advanced telecommunications, and state-of-the-art business facilities.

- Skilled Workforce: Access a talented and multilingual workforce with expertise in various industries.

- Stable Economy: Bahrain has a diversified economy and a stable political environment, providing a secure foundation for business growth.

Types of Foreign Company Registration in Bahrain

- Branch Office: An extension of your parent company, allowing you to conduct business activities in Bahrain under the same name and legal entity.

- Subsidiary Company: A separate legal entity incorporated in Bahrain, offering more autonomy and liability protection.

- Joint Venture: A partnership with a local Bahraini company, combining your expertise with local knowledge and market access.

Bahrain’s Business Dynamics

Bahrain is known for its pro-business policies, which are particularly attractive to foreign investors. The country has established itself as a financial and logistics hub in the region, supported by modern infrastructure and a stable economic environment. Bahrain’s Economic Vision 2030 emphasizes diversification, creating opportunities in sectors like finance, logistics, manufacturing, and technology.

- Skilled Workforce: Bahrain boasts a pool of talented and motivated professionals ready to contribute to the success of your business.

- Strategic Location: Serving as a gateway in the Gulf region, Bahrain connects to a vast market valued at a staggering 2 trillion dollars. This positions your business to swiftly reach and engage with a diverse customer base.

- Supportive Government: Bahrain’s government continually introduces new regulations to foster the growth and success of businesses.

- Quality Lifestyle: With attractive job opportunities, a pleasant way of life, rich culture, and ease of relocation, Bahrain is a preferred location for residents.

- Business-Friendly Environment: Bahrain’s government collaborates closely with business leaders, creating an environment conducive to business growth. They also offer programs to stimulate creativity and growth.

- Diverse Community: Attracting individuals from around the globe, Bahrain is a peaceful haven where people from diverse backgrounds coexist harmoniously.

- Diligent Workforce: Bahrainis take their work seriously, known for their meticulousness, skill, and education. This is a significant advantage for businesses seeking exceptional employees.

- Growing Real Estate Market: Bahrain’s property market is on a rapid ascent, providing diverse housing options and investment opportunities.

- Economic Prospects: Positioned strategically with strong ties to the Gulf region, Bahrain provides businesses with access to a vast market, fostering rapid growth.

- Business Support: Bahrain’s government and local organizations actively provide resources and support, empowering businesses to thrive.

Embrace Bahrain’s Dynamic Business Landscape

Bahrain’s strategic location, supportive government policies, and thriving economy make it an ideal destination for foreign companies seeking to expand their reach in the Middle East. With SetupInBahrain’s expert assistance, navigating the registration process is seamless and efficient, allowing you to focus on your core business objectives.

Ready to establish your presence in Bahrain? Contact us today for a free consultation and let us guide you through the foreign company registration process.

Frequently Asked Questions (FAQs)

What is the minimum capital requirement for foreign company registration in Bahrain?

The minimum capital requirement varies depending on the legal structure and business activities of your company. Our consultants can provide specific guidance based on your needs.

How long does it take to register a foreign company in Bahrain?

The registration process typically takes [timeframe, e.g., 4-6 weeks], depending on the complexity of your application and the required approvals.

Can I own 100% of my foreign company in Bahrain?

Yes, 100% foreign ownership is allowed in many sectors in Bahrain. However, certain industries may have specific ownership restrictions.

What are the tax implications for foreign companies in Bahrain?

Bahrain offers a favorable tax environment with no corporate income tax, personal income tax, or withholding tax on dividends. However, certain sectors, such as the oil and gas industry, are subject to specific taxes.

Foreign Company Registration Packages in Bahrain

Choose Your Package

We offer a range of options to cater to your specific needs and budget. Each package includes expert guidance, streamlined registration, and essential services to get your business up and running efficiently.

3 Months

Includes: Establishing a company with a virtual office and opening a bank account. Residency Fees: BHD 755 for one year, BHD 953 for two years.-

✅ Office Address

-

❌ Internet

-

✅ Telephone Services

-

❌ Receptionist Service

-

✅ Mail Handling

-

❌ Security

-

❌ Cleaning & Maintenance

-

❌ Kitchen

-

❌ Office Boy

-

❌ Parking

-

❌ Printing & Scanning

-

❌ Administration Support

-

✅ Meeting Room

-

❌ VAT Registration

-

✅ Company Formation

6 Months

Includes: Establishing a company with a virtual office and opening a bank account. Residency Fees: BHD 755 for one year, BHD 953 for two years.-

✅ Office Address

-

✅ Internet

-

✅Telephone Services

-

❌ Receptionist Service

-

❌ Mail Handling

-

✅ Security

-

✅ Cleaning & Maintenance

-

✅ Kitchen

-

✅ Office Boy

-

✅ Parking

-

✅ Printing & Scanning

-

✅ Administration Support

-

✅ Meeting Room

-

✅ VAT Registration

-

✅ Company Formation

12 Months

Includes: Establishing a company with Private Cabin and opening bank account. Residency Fees: BHD 755 for one year, BHD 953 for two years.-

✅ Office Address

-

✅ Internet

-

✅ Telephone Services

-

✅ Receptionist Service

-

✅ Mail Handling

-

✅ Security

-

✅ Cleaning & Maintenance

-

✅ Kitchen

-

✅ Office Boy

-

✅ Parking

-

✅ Printing & Scanning

-

✅ Administration Support

-

✅ Meeting Room

-

✅ VAT Registration

-

✅ Company Formation

Simplified Foreign Company Registration in Bahrain

How long does it take to form a company in Bahrain?

The typical processing time for company formation in Bahrain can vary depending on the chosen option and the complexity of the business structure. Here are the estimated timelines for different options:

- Premium Package: 10-15 business days

- Gold Pacakge: 25-30 business days

- Standard Package: 30-40 business days

It’s important to note that these are estimated timelines, and the actual processing time may vary based on factors such as document completeness, government approvals, and unforeseen circumstances.

Premium Package (10-15 Business Days)

Gold Package (25 - 30 Business Days)

Standard Pacakge (35-45 Business Days)

Why Choose Us for Foreign Company Formation in Bahrain?

- Expert Guidance: Our team of seasoned professionals possesses in-depth knowledge of Bahraini regulations and business structures. We provide tailored advice to ensure you select the most suitable option for your specific business goals.

- Streamlined Process: We navigate the intricacies of company formation in Bahrain, handling all the paperwork and procedures on your behalf. This allows you to focus on what matters most - building your business.

- Cost-Effectiveness: We offer competitive pricing structures to ensure a cost-effective company formation experience.

- Local Knowledge: Leverage our extensive understanding of the Bahraini market to make informed decisions for your business.

- Ongoing Support: Our commitment extends beyond registration. We provide ongoing support to address any challenges you may face as your business grows.

Additional Considerations for Foreign Company Registration in Bahrain:

Business Licenses: Depending on your specific industry, you may need to obtain additional licenses from relevant government authorities.

Tax Registration: Register your company for tax purposes with the relevant Bahraini tax authorities.

Ongoing Compliance: Maintain compliance with relevant regulations by filing annual reports and renewing licenses.

Summary about company formation in Bahrain process

Great news – starting your business in Bahrain is a cakewalk, especially for international investors! At Setup in Bahrain, we’re your go-to for crystal-clear and honest company formation consultancy to successfully register your business in Bahrain Company Register Sijilat. Here’s the scoop:

Effortless Process

Tailored Options

No Surprise Costs

Guidance at Your Fingertips

Factors Affecting Processing Time

Several factors can influence the processing timeline, including:

- Complexity of the company structure

- Government agency workloads

- Availability of required documents

Transparency and Guidance

We understand the importance of knowing the timeframe for your company formation. Our team is committed to transparency and can provide a more precise estimate based on your specific situation.

This revised version prioritizes a clear and concise answer at the beginning, presenting the typical processing times for different packages in bullet points. It avoids promotional language and focuses on user needs. Here’s how this can be used with your existing content:

Process Time for Company Formation in Bahrain

The typical process time for company formation in Bahrain can vary depending on the chosen package (see above).

Taxes in Bahrain (November 2024)

Bahrain continues to offer a competitive tax environment for businesses and individuals as on November 10, 2024. There is still no personal income tax, corporate income tax (except for the oil & gas sector), capital gains tax, or inheritance tax. This makes Bahrain an attractive location for establishing a business or relocating as an expat. However, a 10% Value Added Tax (VAT) is applied to most goods and services. Some essential items and specific sectors may be exempt from VAT. It’s advisable to consult with a tax professional to understand the specific implications for your business activities in Bahrain, especially considering any potential future tax changes.

Key Points

- As of November 10, 2024: No personal income tax, corporate income tax (except oil & gas), capital gains tax, or inheritance tax.

- 10% VAT applies to most goods and services (with some exceptions).

Why Choose Company Formation in Bahrain?

Bahrain offers several advantages for businesses considering expansion to the Middle East:

- Strategic Location: Easy access to neighboring countries for trade and collaboration.

- Business-Friendly Environment: Stable economy, government support, and clear regulations.

- Tax Benefits: Favorable tax arrangements due to international agreements (e.g., with the US).

What are the different types of companies in Bahrain?

Bahrain offers a diverse range of company structures to accommodate various business needs. Here are some of the most common types:

- With Limited Liability (WLL): The most popular choice for SMEs, offering limited liability protection to shareholders.

- Public Shareholding Company (PSC): Ideal for large-scale enterprises requiring substantial capital and public ownership.

- Closed Joint-Stock Company (CJSC): A private company with a fixed number of shareholders, often used for family businesses.

- Branch of a Foreign Company: A subsidiary of a foreign company, enabling international businesses to operate in Bahrain.

The selection of a company structure hinges on factors such as ownership, capital requirements, and long-term business objectives

Additional Considerations:

- No minimum capital requirement for company formation.

- Culturally diverse and welcoming environment for foreign entrepreneurs.

- Skilled and multilingual workforce.

- Streamlined processes for visas and work permits.

- Competitive office space options.

- Financial hub with easy access to banking and insurance services.

Overall Benefits:

Choosing Bahrain offers a combination of strategic location, a supportive business environment, and tax advantages. This makes it an attractive option for international businesses looking to establish a presence in the Middle East.