This is not theory. Since 2018, we have helped over 2,500 entrepreneurs from forty-plus countries register companies in Bahrain — from solo consultants in the United Kingdom to trading firms expanding from Saudi Arabia and the United Arab Emirates, to tech startups relocating from Hong Kong and South Africa. Every section below reflects the real company formation process we handle daily: the exact steps, the actual government fees, the documents that cause delays when prepared incorrectly, and the ownership rules that determine whether your business type qualifies for 100% foreign ownership. If you are evaluating Bahrain against Dubai, Riyadh, or other GCC countries — this guide gives you every detail you need to make informed decisions about setting up a company in the Kingdom of Bahrain.

Content is verified against the 2025 amendments to the Commercial Companies Law (Legislative Decree No. 38 of 2025) and written by ACMA/CPA-qualified practitioners who handle company incorporation and company setup daily. Read the full guide, or jump straight to the section that matters most to you.

Why Choose Bahrain for Your New Company? Strategic Location, Business-Friendly Environment, and Full Foreign Ownership

Every investor asks the same question first: why Bahrain and not somewhere else? Three things set the Kingdom apart from every other jurisdiction in the Gulf Cooperation Council.

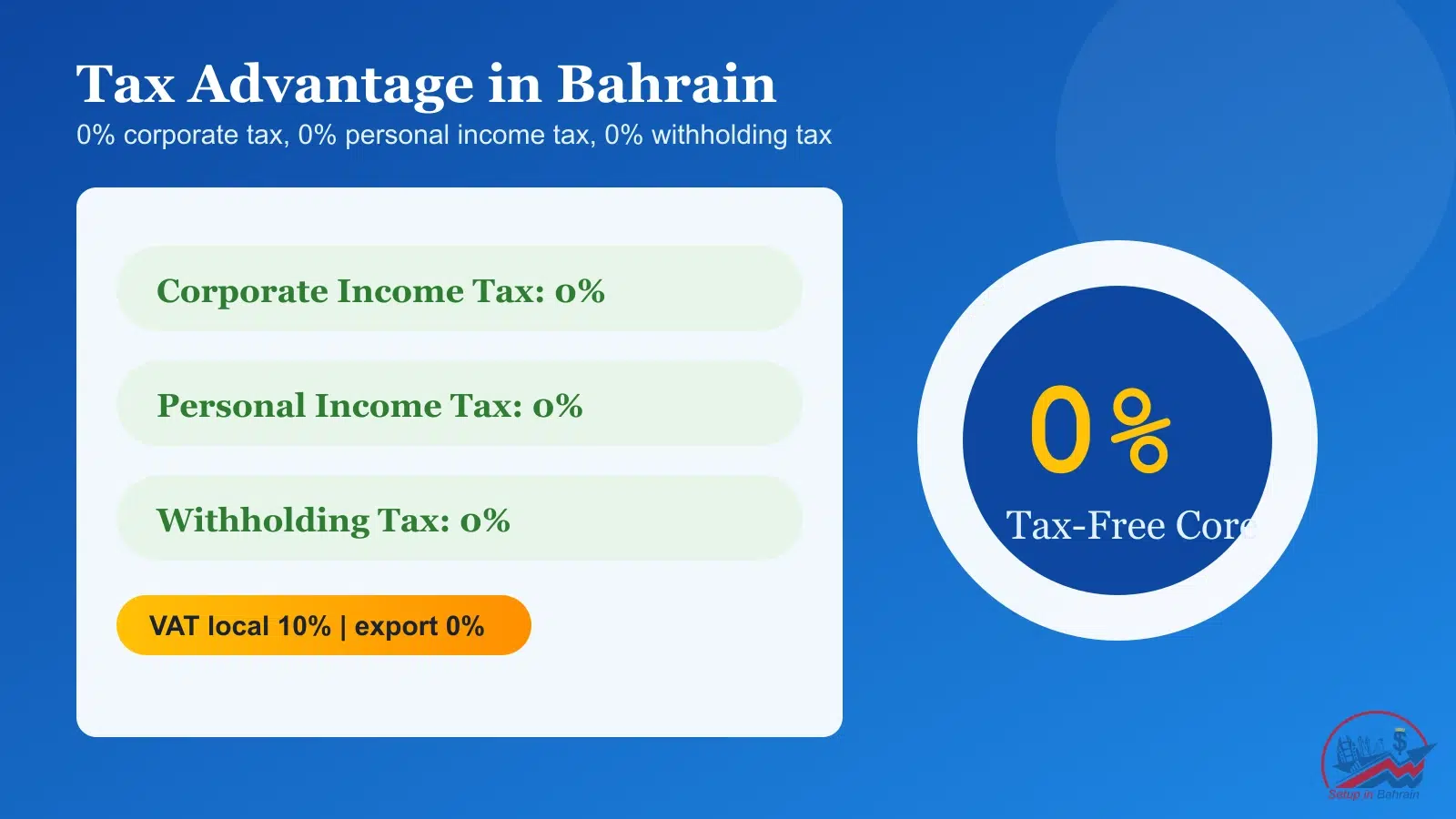

Zero Corporate Tax, Zero Personal Income Tax, and Full Profit Repatriation

Bahrain applies zero percent taxation across all major categories — confirmed by the 2026 U.S. Investment Climate Statement. No corporate income tax on profits. No personal income tax on salaries and dividends. No capital gains tax. No withholding tax. No tax on repatriation of funds. You keep everything you earn.

| Tax Type | Rate |

|---|---|

| Corporate Income Tax | ✓ 0% |

| Personal Income Tax | ✓ 0% |

| Capital Gains Tax | ✓ 0% |

| Withholding Tax | ✓ 0% |

| Tax on Repatriation of Funds | ✓ 0% |

| Value-Added Tax (local sales) | 10% |

| Value-Added Tax (service exports) | ✓ 0% |

The current VAT rate sits at 10% on local sales but drops to 0% for service exports, making Bahrain an attractive destination for digital agencies, SaaS firms, and international business operations serving clients in Saudi Arabia, the United Kingdom, the United Arab Emirates, and beyond. A British consultant billing overseas clients pays zero VAT. An Indian SaaS company exporting globally retains 100% of revenue after costs. These are not promotional claims — this is the legal framework confirmed by the National Bureau for Revenue.

GCC Markets, International Business, and Free Trade Agreements

Bahrain's strategic location at the centre of the Gulf region places your corporate entity within reach of 1.5 billion consumers across the GCC markets and wider Middle East. The Kingdom is connected to Saudi Arabia by the King Fahad Causeway — direct road access to the largest economy in the region. Backed by a Free Trade Agreement with the United States, bilateral trade agreements with EFTA nations, New Zealand, and Singapore, and a financial sector regulated by the Central Bank of Bahrain, the Kingdom gives global businesses and financial institutions a credible base in the Gulf Cooperation Council.

The ease of doing business consistently ranks among the highest in GCC countries. Whether you are a startup founder, an established business owner expanding regionally, or a parent company setting up a Branch Office — Bahrain's business opportunities are real and accessible.

What Makes Bahrain's Business Environment Attractive for Foreign Investors?

Foreign investment laws allow full ownership across almost 95% of registered business activities, covering a wide range from consulting and professional services to manufacturing, financial services, real estate management, and technology. No local sponsor or local partner required for most business sectors. Profit repatriation faces zero restrictions. The regulatory framework supports foreign entrepreneurs with streamlined digital processes, English-language documentation, and a transparent legal framework under the Commercial Companies Law.

What Is the Company Formation Process in Bahrain?

The Bahrain company formation process follows five clear steps through a centralised digital system. Each step must complete before the next begins. The full incorporation process takes fifteen to twenty business days — the fastest company registration process in the Gulf Cooperation Council.

Step 1: Security Clearance and Document Preparation

🕐 3–5 business daysSubmit passport copies for all shareholders and directors to the NPRA (Nationality, Passports, and Residence Affairs). This background check screens international databases for financial crimes, deportations, and security concerns. Standard security clearance takes three to five business days. A rejection here terminates the registration application entirely.

What makes or breaks this step is document preparation. Gather all company documents before you begin: valid passports (minimum 6 months validity), identification documents, and any corporate authorisation letters. Incomplete submissions add three to five business days per correction cycle.

Step 2: Company Name, Commercial Name Reservation, and Legal Structure Selection Through the Sijilat Portal

🕐 3–5 business daysSubmit three proposed Company Names ranked by preference through the Sijilat portal. The Ministry of Industry and Commerce reviews each Commercial Name against existing registrations and naming guidelines during the name reservation stage. Reserved names stay valid for sixty days. Business names must be unique, appropriate for commercial use, and available in English and Arabic. Complete your application form accurately — name registration errors delay the entire company formation process.

Step 3: Register Your Business Address — Physical Office, Virtual Office, or Office Space

🕐 3–5 business daysEvery company needs a municipality-approved registered address — your official business address and commercial address for all government correspondence. Depending on your business activities and business type, you can use a physical office, local office, co-working space, business center, or a licensed Virtual Office.

The municipality may conduct digital photo audits to verify signage and functionality. Virtual Office arrangements satisfy specific requirements for consulting, technology, holding companies, and other service providers without client-facing business operations. The office lease or lease agreement you secure becomes a mandatory component of your company documents — and an expired one triggers immediate CR suspension.

Step 4: Articles of Association, Memorandum of Association, and Power of Attorney

🕐 1 hourYour Articles of Association define shareholder rights, Board of Directors authority, minimum share capital, and operational procedures. The Memorandum of Association outlines your company structure, ownership distribution, and permitted commercial activities. These legal documents go to the Ministry of Justice for notarisation.

Standard deeds through the Sijilat system can be signed electronically. If you cannot attend in person, a notarised power of attorney or Authorization Letter allows your representative to sign on your behalf. A legal expert or company formation services provider prepares these company documents to ensure full compliance with local regulations and regulatory requirements.

Step 5: Corporate Bank Account, Business Bank Account Opening, Capital Deposit Certificate, and Office Address Activation

🕐 1 hourOpen your corporate bank account and deposit minimum share capital. The legal minimum is one dinar, but we recommend one thousand dinars — banks and financial institutions flag minimal capitalisation as a risk indicator. Once the bank issues your capital deposit certificate, the Ministry of Industry and Commerce activates your Commercial Registration certificate. You are now legally operational.

Opening a business bank account in Bahrain typically takes one to two business days when your document preparation is complete. The signatory must attend in person — this is one of only two steps requiring physical presence (the other is the Investor Visa medical examination).

Who Can Register a Company? Foreign Investors, Bahraini Nationals, and GCC Citizens

Bahraini nationals, GCC nationals, and foreign individuals or corporations can all register a company in Bahrain. Eligibility depends on your nationality, proposed business activities, business type, and business plan alignment. Most service, professional services, and manufacturing activities permit full foreign participation across a wide range of business sectors.

Foreign investors and foreign entrepreneurs register as sole shareholders or alongside partners. You need a valid passport, financial background verification, and security clearance. Overseas corporations establish local subsidiaries (an independent legal entity with limited liability) or Branch Office extensions (the parent company retains full responsibility). Foreign individuals from the United Arab Emirates, United Kingdom, United States, Hong Kong, New Zealand, Czech Republic, and Costa Rica all benefit from Bahrain's open foreign investment policies.

Bahraini nationals face no ownership restrictions in any business sector. GCC nationals receive equivalent treatment under regional economic agreements. American citizens and investors from Singapore benefit from expanded access under bilateral trade agreements.

Full Foreign Ownership and Full Ownership Without a Local Sponsor or Joint Partners

Cabinet resolutions identify over three hundred fifty activity codes where international investors hold complete equity. The ownership framework eliminates sponsorship arrangements common in neighbouring jurisdictions like the United Arab Emirates and Saudi Arabia. Foreign shareholders maintain direct control over management decisions, profit distribution, and corporate governance. Profit repatriation faces zero restrictions — you transfer dividends, capital gains, and original investment to any global destination without withholding taxes. No local sponsor. No joint partners. Full ownership and full control.

Which Business Activities and Business Sectors Allow Full Foreign Investment?

Eligible activities span consulting, technology services, manufacturing, trading, logistics, education, financial services, and professional services. Export-oriented service providers qualify regardless of specific activity codes. Businesses in Bahrain free zones, including the Bahrain International Investment Park, also benefit from tax exemptions and streamlined regulatory requirements. The range of business sectors open to full foreign ownership continues to expand under Bahrain's economic diversification strategy.

The Regulatory Authority maintains activity classifications that specify ownership thresholds by nationality and commercial activity. These change periodically based on Government of Bahrain directives. Checking the activity relationship list before submitting your registration application prevents discovering restrictions after you have paid registration fees and invested time.

Restricted Sectors: Financial Services, Central Bank Licensing, Local Partner, and Necessary Licenses

Construction activities require 51% Bahraini ownership. Domestic trading (retail, wholesale) requires a nominal Bahraini local partner — one share out of ten thousand. Financial services need Central Bank of Bahrain authorisation. Healthcare provision requires NHRA licensing. Educational institutions need Ministry of Education approvals. Certain activities also require industrial licenses, necessary licenses, or sector-specific licenses before business operations can begin. Always verify specific requirements with the relevant authorities before proceeding.

Limited Liability Under Article 18 bis

Article 18 bis of the Commercial Companies Law creates a statutory barrier between your company obligations and personal assets. Creditors can pursue the company but cannot touch shareholders beyond their capital contributions. If the company fails, you lose only what you invested. Personal bank accounts, real estate, and other assets stay protected. This liability protection framework is one of the strongest in the GCC countries — a key reason foreign investors choose Bahrain over competing jurisdictions.

Types of Companies in Bahrain: W.L.L, Branch Office, and Entity Types

Choosing the right type of company determines ownership flexibility, liability exposure, and regulatory compliance obligations. The legal framework under the Commercial Companies Law provides multiple company structure options for different business goals. Here is what each entity type offers:

WLL Company (Limited Liability Company) and Single Person Company

The W.L.L is the most popular company type for foreign investors, foreign entrepreneurs, and small business owners. A WLL company permits single or multiple shareholders, flexible capital, and 100% foreign ownership for most business activities. Liability stays limited to your capital contribution. You register multiple commercial activities under one CR. The number of shareholders ranges from one to fifty individuals or corporate entities.

| Feature | Detail |

|---|---|

| Shareholders | 1–50 (individuals or corporate) |

| Minimum Share Capital | BHD 1 (legal) / BHD 1,000 (recommended) |

| Foreign Ownership | Up to 100% |

| Liability | Limited to capital contribution |

The previous Single Person Company (SPC) and Sole Proprietorship designations merged into the WLL framework under the 2025 amendments to the Commercial Companies Law. A single shareholder now owns 100% of a Limited Liability Company with full liability protection under Article 18 bis. Same benefits, simplified corporate structure.

Branch Office, Foreign Branch, and Foreign Company Registration

A Branch of a Foreign Company extends your existing international business into Bahrain without creating a separate legal entity. The parent company retains full responsibility for branch obligations. Registration requires parent company authorisation, financial statements, a Board of Directors resolution, and a locally resident manager. No minimum share capital applies to Foreign Branch operations. This corporate structure works well for established companies testing the Bahrain market before committing to a full subsidiary.

Partnership Company, Sole Proprietorship, and Limited Partnership

A Partnership Company suits ventures where two or more partners share management and profits. All partners carry joint and personal liability for company obligations — meaning personal assets are at risk. A Sole Proprietorship (now merged into the WLL framework for most purposes) was traditionally available to Bahraini and GCC nationals for simpler business operations. A limited partnership combines general partners with full liability alongside limited partners whose risk stops at their capital contribution.

Public Shareholding Company, Closed Joint Stock Company, and Bahrain Shareholding Company

A closed joint stock company requires minimum share capital of two hundred fifty thousand dinars and restricts share transfers — suited for private equity and family enterprises. A Public Shareholding Company requires one million dinars minimum and at least seven founders, with shares tradeable on the Bahrain Bourse. Both Bahrain Shareholding Company structures carry specific capital requirements and regulatory requirements that differ significantly from WLL formations. Consulting with a legal expert before selecting these structures prevents costly compliance gaps.

Free Zone Company and Representative Office

A Free Zone Company registered in Bahrain free zones such as the Bahrain International Investment Park offers additional tax exemptions and simplified regulatory compliance. A Representative Office allows market research and liaison activities without full commercial activity — ideal for companies evaluating business opportunities before full entry. Investment vehicles operate under Central Bank supervision. Each business entity type addresses distinct business goals and operational strategies.

How Long Does the Company Registration Process Take?

Fifteen to twenty business days from registration application to Commercial Registration activation — the fastest in the Gulf Cooperation Council:

| Step | Task | Duration |

|---|---|---|

| 1 | Security Clearance (NPRA) | 3–5 business days |

| 2 | Commercial Name Reservation | 3–5 business days |

| 3 | Business Address / Registered Address | 3–5 business days |

| 4 | Deed of Association Signing | 1 hour |

| 5 | Corporate Bank Account & Capital Deposit | 1 hour |

| Buffer | Coordination & Appointments | 5 business days |

Bahraini-owned businesses and those with American or GCC nationals as owners often complete faster due to streamlined vetting. Incomplete submissions add three to five business days per correction cycle. Working with experienced company formation services providers reduces these delays significantly. Comparable timelines in the United Arab Emirates run twenty-five to thirty-five business days; Saudi Arabia takes twenty to forty.

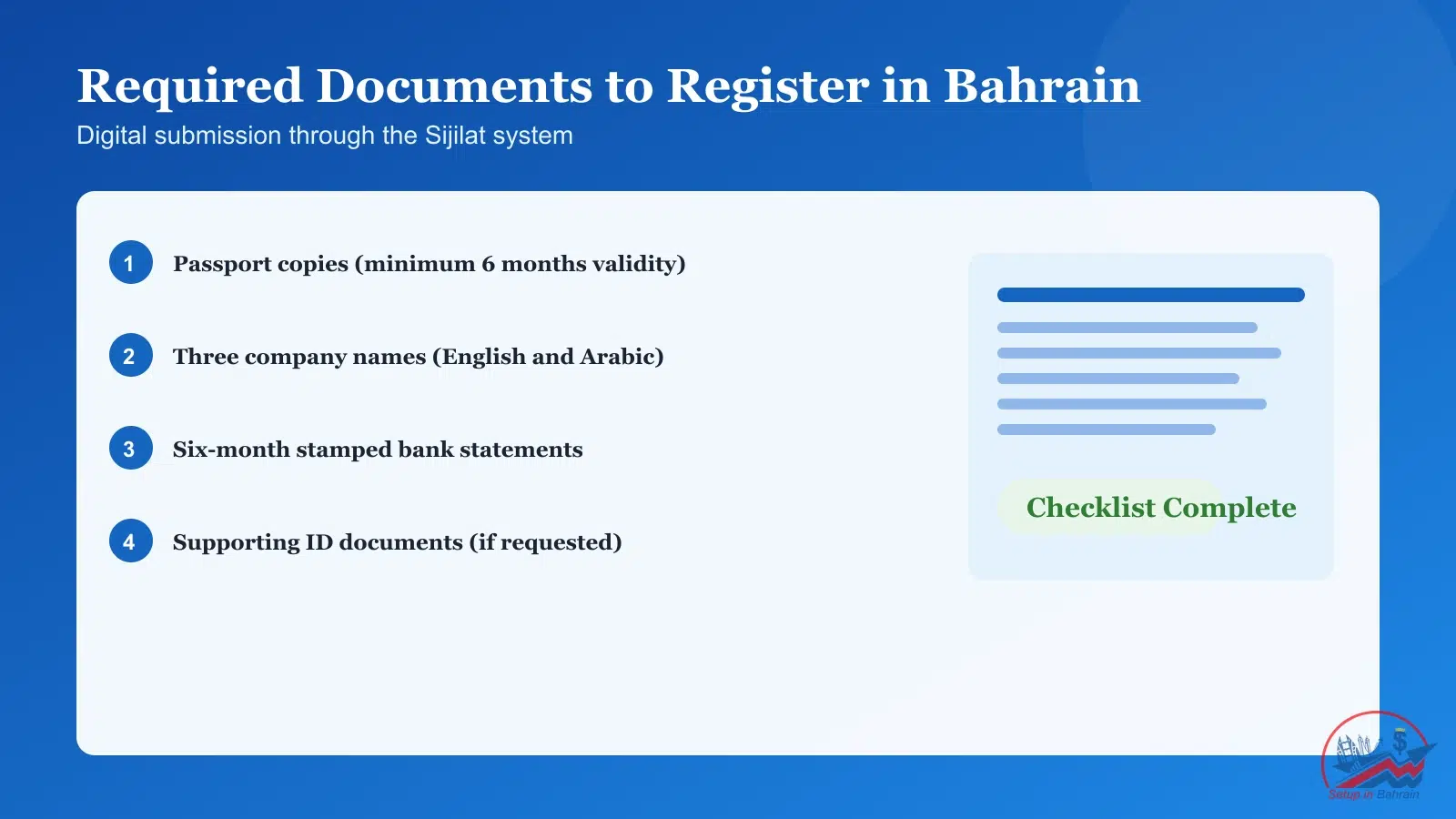

What Required Documents, Passport Copies, and Legal Documents Do You Need?

Document preparation determines your timeline. You need five items, all submitted digitally through the Sijilat portal:

- Passport copies for all partners (minimum 6 months validity). GCC residents also provide CPR/Emirates ID/Iqama. Corporate shareholders provide certificate of incorporation, Board of Directors resolution, and power of attorney. All company documents must be current and legible.

- Three proposed Company Names ranked by preference — unique, commercially appropriate, available in English and Arabic. The name reservation step confirms availability within three to five business days.

- Six-month bank statements (stamped by issuing bank) for source of funds verification and AML compliance. Ensure they reflect legitimate income — unexplained deposits from sanctioned jurisdictions trigger delays during compliance checks.

- Additional identification documents if requested by the bank or government authorities: driving licence, national identity card, secondary passport, or proof of business address.

- BHD 1,000 capital deposit — the bank issues a capital deposit certificate on the same day, which activates your Commercial Registration certificate.

A formal business plan is not mandatory for business registration but is strongly recommended for corporate bank account opening (AML due diligence), Investor Visa approval, and real estate or office lease applications. Having your required documents organised is the single most impactful thing you can do to accelerate the company formation process.

Government Authorities, Regulatory Authority, and Legal Compliance

Six government authorities and relevant authorities review your registration. Understanding who checks what prevents surprises:

| Authority | Role | What They Check |

|---|---|---|

| MOICT | Commercial licensing & business registration | Business activities, ownership, capital compliance |

| NPRA | Security clearance | Background, financial crimes, deportations |

| LMRA | Work permits & employment | Payroll, WPS compliance, visa services |

| NBR | Tax administration | VAT registration & filing |

| Municipality | Business address verification | Zoning, signage, commercial use |

| Central Bank | Financial sector licensing | Banking & financial services approval |

The LMRA manages all work permits and payroll compliance post-registration. The National Bureau for Revenue requires VAT registration once annual turnover exceeds BHD 37,500. Activity codes assigned during Bahrain company registration define your operational boundaries — operating beyond them triggers fines and registration suspension. Each Regulatory Authority has specific requirements your business entity must satisfy.

What Compliance Checks Apply During the Company Formation Process?

Regulatory authorities verify that your investment funds come from legitimate sources. Legal compliance reviews examine transaction patterns, account history, and consistency between stated occupation and financial capacity. This rigour is what makes Bahrain company registration respected by international financial institutions and tax authorities globally.

Common triggers for additional review include: large cash transactions, multiple international transfers, complex corporate structures, cryptocurrency or precious metals trading, or a history of company liquidations. Prepare financial statements and supporting materials before submission to meet all compliance requirements and regulatory requirements efficiently.

How Does the Digital Registration Process Work Through the Sijilat Portal?

Everything runs through the Sijilat portal — a centralised online system connecting all government authorities. You submit company documents electronically, track progress in real time, and receive notifications at each Initial Approval milestone. No paper submissions for standard procedures. Physical presence is only required for bank account opening (the signatory must attend in person) and the Investor Visa medical examination. All other steps in the company formation process happen remotely with authorised representation — making business setup in Bahrain accessible from anywhere in the world.

What Are the Government Fees? Transparent Pricing and Company Formation Packages

Government fees and registration fees are fixed and standardised through the Sijilat portal with transparent pricing. Variable setup costs depend on your business address choice (physical office vs Virtual Office) and minimum capital requirements for your chosen business type.

For the full breakdown of government fees, Company Formation Package comparisons, and total investment scenarios, see the cost of setting up a company in Bahrain guide. Standard government registration fees sit around BHD 432. Total company formation packages (including office address, document preparation, and professional fees) range from BHD 1,340 to BHD 2,150 depending on lease agreement duration and service level.

Corporate Tax, Corporate Income Tax, Personal Income Tax, and VAT Registration in Bahrain

Bahrain applies zero percent taxation across all major categories. These tax exemptions are why business owners, small business founders, and foreign entrepreneurs choose Bahrain over higher-tax jurisdictions in the Gulf Cooperation Council.

Value-Added Tax on Business Operations and Service Exports

The National Bureau for Revenue administers Value-Added Tax at 10% on local supplies. Service exports carry a zero rate when the order originates outside Bahrain. Digital agencies, SaaS companies, and consulting firms serving clients globally retain higher profit margins. VAT registration becomes mandatory once your annual turnover exceeds BHD 37,500 — voluntary registration is available below this threshold.

Bahrain has signed double taxation avoidance agreements with countries including the Czech Republic, South Africa, Isle of Man, San Marino, Costa Rica, and Antigua and Barbuda — protecting your international business income from being taxed twice.

Corporate Tax for Oil and Gas and Large Enterprises in 2027

Oil and gas extraction faces a 46% rate. Bahrain launches a broad-based corporate income tax in 2027 for enterprises with revenues exceeding one million dinars — small business and medium enterprises remain unaffected. Large multinational enterprises face OECD Pillar Two requirements (15% minimum for groups exceeding EUR 750 million revenue). The current tax-free environment remains a decisive advantage for business owners evaluating jurisdictions across the Middle East.

Business Registration vs Business License Under the Commercial Companies Law

Business Registration creates your company's legal existence and corporate structure. A Business License — sometimes called a trade license — authorises specific business activities within that business entity. You can hold one registration with multiple Business License approvals for different commercial activity categories.

Selecting the wrong activity code during your registration application can trigger ownership restrictions or rejection — accuracy here matters for a successful business outcome. Your Commercial Registration certificate carries your legal Commercial Name, registration number, permitted business activities, and expiration date. Banks, government authorities, financial institutions, and commercial partners all check this before engaging with your new company.

Which Business Activities Are Restricted or Require Special Approval?

Restricted activities fall into three categories: Bahraini majority ownership required (construction, government contracts), nominal local participation required (domestic retail trading), and specialised regulatory licensing required (financial services, healthcare, education). The negative list includes document clearance offices, religious pilgrimage services, and small-scale traditional retail — reserved for Bahraini nationals.

Conditional sectors may open to qualified applicants based on investment size, technical qualifications, and partnership arrangements. Always check the activity classification, necessary licenses, and any additional licenses with the Regulatory Authority before submitting.

Why Is a Business Address Mandatory? Office Lease, Lease Agreement, and Registered Address

Your registered address is the fixed location for government correspondence, inspection visits, and legal service. The business address serves as your official commercial address in all government and banking records.

Physical offices suit manufacturing, retail, and client-facing service providers who need a local office for daily business operations. Virtual Office arrangements satisfy regulatory requirements for consulting, technology, holding companies, and international business trading — significantly reducing overhead for new company launches. The municipality conducts periodic inspections.

An expired office lease or lease agreement prevents CR renewal, freezes bank accounts, and revokes active Investor Visa and work permits. Treat your office address as a living compliance obligation, not a one-time setup task.

Can Foreign Investors Manage Business Operations From Outside Bahrain?

Yes. After the initial formation visit, foreign investors operate 100% remotely using the Sijilat portal and digital banking infrastructure. CR renewals, VAT filings, employee WPS 2.0 payments, and Ministry of Industry and Commerce correspondence all process electronically. You need a resident manager and a valid office address. The foreign owner does not need to live locally.

Initial visit is required for: Articles of Association notarisation, banking signatory setup, and Investor Visa medical examination. This remote management capability is a key advantage of business setup in Bahrain compared to jurisdictions requiring permanent physical presence.

Investor Visa, Work Permits, and Visa Services After Registration

After your Commercial Registration certificate activates, you apply for an Investor Visa through the LMRA. This residency permit lets you live and conduct business in Bahrain, sponsor family members, and open personal bank accounts. Processing takes five to seven business days after CR activation.

The Investor Visa is one of the most valuable outcomes of company formation in Bahrain — long-term residency alongside your business registration. Additional visa services for employees and dependants process through the same authority. Work permits for staff require LMRA registration, job approval, and wage protection system enrolment.

What Happens After Business Registration Is Completed?

Your company is live. Now maintain regulatory compliance and legal compliance across all business operations:

- Annual CR renewal before expiration — late renewals incur penalties starting at one hundred dinars per month. Government fees for renewal are standardised through the Sijilat portal.

- Continuous business address validity throughout the registration period. Renew your office lease before it expires.

- LMRA registration and work permits processing plus wage protection system compliance for all employees.

- VAT registration and filing (monthly or quarterly) if registered with NBR. Timely filing prevents penalties.

- Beneficial ownership updates annually for AML compliance requirements.

- Social insurance registration for all staff.

Full details on annual renewal are in the CR renewal guide. A gap in legal compliance triggers registration suspension, account freezes, and visa cancellation.

What Common Issues Delay Approval in the Company Formation Process?

Incomplete documentation — missing passport pages, unsigned forms, or omitted financial statements return your registration application to the end of the review queue. Three to five business days lost per correction. Ensure all required documents are complete before submission.

Activity mismatch — a commercial activity requiring local participation cannot proceed with full foreign ownership. Resolving this means adjusting ownership or substituting business activities.

Compliance gaps — unexplained wealth, inconsistent transaction histories, or adverse background findings create barriers. Full transparency from the first submission is mandatory. Expert guidance from an experienced company formation services provider helps clear these compliance requirements.

When Company Formation in Bahrain May Not Be Suitable

Capital-intensive projects requiring public fundraising may find deeper capital markets more practical. Pharmaceutical manufacturing, advanced financial products, and specialised telecommunications have more established regulatory frameworks elsewhere. Businesses targeting exclusively local markets without regional expansion plans derive limited benefit from Bahrain's positioning as a GCC gateway. Understanding these limitations helps you make informed decisions about whether Bahrain aligns with your business goals.

Company Formation Services, Business Setup Services, and Free Consultation

Our company formation services cover every step — from document preparation through corporate bank account opening and Investor Visa processing. Business Setup Services include a municipality-verified registered address, high-speed internet, telephone lines, receptionist services, mail handling, and compliance support throughout your company setup.

Company Formation Package options:

| Package | Duration | Includes |

|---|---|---|

| Standard | 3-month lease agreement | Office address, CR processing, bank account setup |

| Gold | 6-month lease agreement | Everything in Standard + extended compliance support |

| Premium | 12-month lease agreement | Everything in Gold + Investor Visa processing + priority support |

All packages ensure regulatory compliance with Ministry of Industry and Commerce requirements from day one — transparent pricing with no hidden government fees. For pricing details, see the cost of setting up a company in Bahrain guide.

Frequently Asked Questions About Company Formation in Bahrain

Start Your Company Formation in Bahrain Today

The company formation framework operates under established commercial law and a transparent legal framework administered through the Sijilat digital system. Foreign investors receive ownership rights comparable to Bahraini nationals across most business activities, liability protection under Article 18 bis, and unrestricted profit repatriation. Standard formations complete within fifteen to twenty business days. Government registration fees are fixed. Building a successful business through company setup in Bahrain starts with clear activity mapping, stamped financial statements, and a municipality-compliant office address.

Ready to register your company? Contact Setup in Bahrain for a free consultation — expert guidance and compliance support from the outset. Our company formation services cover everything from document preparation to corporate bank account opening, Investor Visa processing, and ongoing regulatory compliance.